There is this common adage that gets thrown around in startup circles that “Ideas don’t matter, and it’s all about the execution“. In fact, you can see for yourself what Google says when you search for “It’s not the idea, it’s the execution.” I was fed this “conventional wisdom” as well, and for a long time I believed it too. But, I think I’ve gone around the block enough times now to be able to have established my own opinion and to be bold enough to stand up and call bullshit to this so called conventional wisdom, which has no wisdom at all.

The truth is that Ideas DO Matter. Founders know this at the bottom of their heart — because their idea is like their precious little baby. In fact, most founders tend to take it to the other extreme that they don’t want to share their idea (subject of another future blog post on why Stealth is Overrated). That’s when they get told and beaten into them that it’s not about the idea.

Well, it is about the idea. The idea is the seed. It is the kernel that is the start of something new. And yes, some of those seeds may be dead on arrival, some may sprout for a short period of time, some grow into saplings, and others become trees (Oaks, Sequoias, Redwoods, and some into beautiful Baobab trees). It takes a lot of nurturing, a.k.a execution, in order for the seed to grow. It must weather a lot of storms and droughts (almost running out of money) along the way and remain standing through all of them. So yes, execution matters, but starting with the right seed also matters.

Ideas are immensely powerful. As Victor Hugo very appropriately put it, “On résiste à l’invasion des armées; on ne résiste pas à l’invasion des idées.”, loosely translated as: “No army can stop an idea whose time has come.” Ideas are powerful because they invade the mind. Once you are introduced to an idea, you cannot get it out of your head. It is the power of ideas that leads to revolutions, be it the French Revolution, the Russian Revolution, the American Civil War, or what we see today in the form of the Arab Spring.

In my prior life as an HCI researcher, one of the things we used to say is that “the problem with HCI is that if you do your job right, the solution is obvious.” i.e. if you design the interaction correctly, then the reaction should be “duh, obviously that’s the right way to do it.” That’s the reaction people have to the iPad — “of course that’s how the iPad should work.” But they forget that we’ve had pen and touch screen devices for years, if not decades before. The magic of Apple and the iPad was to get the interaction just right so that it feels fluid and natural. It’s the same with startup ideas. In hindsight everyone has the same reaction, “duh, obviously people will want to stalk their friends (Facebook) and know when some random person is brushing their teeth (Twitter)” But the process of getting there the first time is the hard part. It is the iteration on the interaction design (in the case of HCI) and the iteration on the idea (in the case of startups) that takes a lot of hard work to get right.

In the context of startups, ideas are what provide that little twist of ingenuity that can make or break a company. In my own experience — my first company started on the basis of a very fundamental idea — what if people can interact with each other on the web. That little theme is what lead to the creation of iMeet for live web conferencing, iServe for live pre-sales customer service on the web. For CardMunch, one of the recent startups I co-founded, the ideas were again simple, 1) Contacts now live on the phone 2) OCR doesn’t work, so let’s use crowdsourcing. In either case these were not revolutionary ideas, but they were what got the ball rolling and without them, that wouldn’t have happened. The best ideas are often simple ones. Maybe that is what a revolutionary idea is — an idea so simple that it sparks a revolution.

For Google, it was the idea of PageRank. Did search engines exist before? Sure they did. But it was that little spark of innovation, coupled with years of execution that got Google going. In fact even Google “borrowed” its idea of search advertising from what used to be called Goto.com and then became Overture.com. (Kudos to Bill Gross here for his role in Goto.com). That is a perfect example of how the idea mattered, but it also needed the execution to make it flourish.

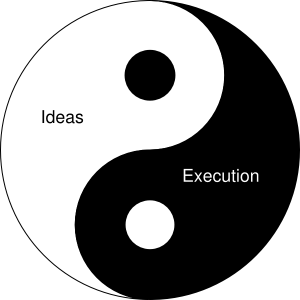

Ideas and Execution are Yin and Yang of the startup world. You need both in order to make magic happen. You need the right idea and the right team that is capable of executing on that right idea. One without the other will fall flat on its face eventually. You may have a brilliant idea, but if you can’t execute it, it’s not going to happen. On the contrary, and this is what people forget, that you might have an absolutely stellar team, but if the idea isn’t right, even a stellar team isn’t going to be able to pull it off.

In the investment circles there’s always this other conventional wisdom that it’s all about the team. To some extent that is true.The reason for that is that if you have a great team, they will figure out quickly that they’re working on the wrong idea and will search and persist until they find the right idea. However, that process of searching and persisting isn’t free, it comes at the cost of time and money. For big VC firms money isn’t an issue, since they use it as a tool to just increase their ownership in the company (often VCs don’t want their companies to be capital efficient — that’s another blog post in itself, which I’ll write about later). In my limited experience as a seed investor, I’ve learnt that it is important to have both a good idea and a good team.

And it is because ideas matter that founders’ equity splits should also reflect that. If one person has an idea and brings in one or two more co-founders to join in, even if nothing is built yet, it shouldn’t be an even equity split. In fact, it should almost never be an even equity split.

The idea does and should have value associated with it, and that value should be reflected in the equity structure of the company. This may wary greatly from company to company and how much work the idea-originating founder has done to develop the idea before bringing on additional co-founders, but in general, I would say that the idea is typically worth anywhere between 10%-30% of a bump in equity with 15% sounding about right. (Splitting equity amongst founders is hard. My former board member from SneakerLabs (my first startup), Frank Demmler, has a great article on this topic: Cutting Up the Founders’ Pie)

When I started writing this post, I wanted to have a cartoon of Archimedes jumping out of the bath tub — not only because that’s the image I have in my head when I think of an idea, but also because sometimes (and more often than not for me!) good ideas do come in the shower. I didn’t know when I started searching that Eureka! is the California State Motto. So appropriate. Silicon Valley is not only about execution. It is about executing on ideas.

So the next time some one tells you that it’s not about the idea, it’s about the execution, tell them to stuff it, because you know better. It’s about both. And one without the other isn’t going to work. Ideas Matter.

Update as of Tuesday, June 21, 4:15 PM PT: In the post above I mentioned that an idea is worth anywhere from 10%-30% of an equity bump, with about 15% sounding about right. Well, turns out there is research to support that. Harvard Business School professor Noam Wasserman conducted research which suggests that the “Idea Premium” was consistently around 15%.

You can follow me on Twitter at @ManuKumar, or, follow @K9Ventures for just the K9 Ventures related tweets.