42: The Answer to the ultimate fund size?

Those of you who have read or watched the Hitchhiker’s Guide to the Galaxy are aware of the pop culture meme around the number 42. Yes, 42: The answer to life, the Universe, and everything. For anyone who hasn’t seen the movie, here’s a clip courtesy of YouTube for the reference. Enjoy watching…

It took the supercomputer Deep Thought (the name seems oddly fitting with the current buzz around Deep Learning!) 7 ½ million years to calculate The Answer. It’s taken me and K9 a mere 5 years since Fund II to get to The Answer. So with that…

I’m pleased to announce the formation and closing of K9 Ventures III, L.P., a $42M technology-focused Pre-Seed fund.

The new fund, which closed on August 8th, 2017, will continue to execute on the same strategy as our prior fund: be highly selective and concentrated in the investments we make (3-4 investments per year); be the first institutional money (frighteningly early) into the company, mostly leading investments at Pre-Seed; invest in companies that are creating new technology platforms or new markets; and focus on companies that are geographically located in the San Francisco Bay Area.

K9’s last fund, K9 Ventures II, L.P., was a $40M fund. It was a conscious decision to maintain the fund size at the same level, despite both market pressure (larger rounds at earlier stages) and demand pressure (lots of LP money entering the stage) to raise a larger fund. I believe that fund size is a slippery slope, in which the pressure of having to invest more capital forces venture firms to make investments in increasingly later-stage companies with larger check sizes. The slight change in fund size for K9 was driven by my desire to increase my own participation in the fund while accommodating LP interest, and also because I’d joked that I’m going to index K9’s fund sizes to my age. And yes, I’m presently 42.

The investing strategy for K9 stands in stark contrast to most “early-stage” (incubators, accelerators, pre-seed and seed stage) investing. At K9 we do the opposite of the volume game. We don’t invest in a lot of companies and hope that one or two of them will be big hits. Instead, we want every company we invest in to be successful. While that may not be an achievable goal, that is our North Star. The small and concentrated portfolio means that K9’s interests are always well aligned with the interests of founders who choose to work with us.

I’m grateful to have had the opportunity to work with some absolutely amazing founders in the K9 portfolio and look forward to the many more amazing founders that K9 will get to partner with. Founders have a vision of what the world will be like in the future. It is humbling for me to be able to play a tiny part in building the future they envision and bring to life. So I would like to thank all the K9 Founders for the magic that they do, and for allowing me and K9 to be along for the ride.

The new $42M fund is backed by several high quality institutional partners, including university endowments, fund of funds, family offices, and key individuals. I would like to thank all the limited partners who entrust me and K9 to invest their capital. They put an enormous amount of trust and faith in me, especially as a solo-GP fund, and the responsibility of that trust is something I wake up with every morning. My goal for K9 is not only to provide stellar returns, but to back companies that make a mark and have a positive impact on the world while doing so. That’s a mission I could not embark upon without partners who share and believe in K9’s approach to company building. I especially want to acknowledge the returning LPs from Fund I and Fund II — your continuing support for me and K9 is much appreciated.

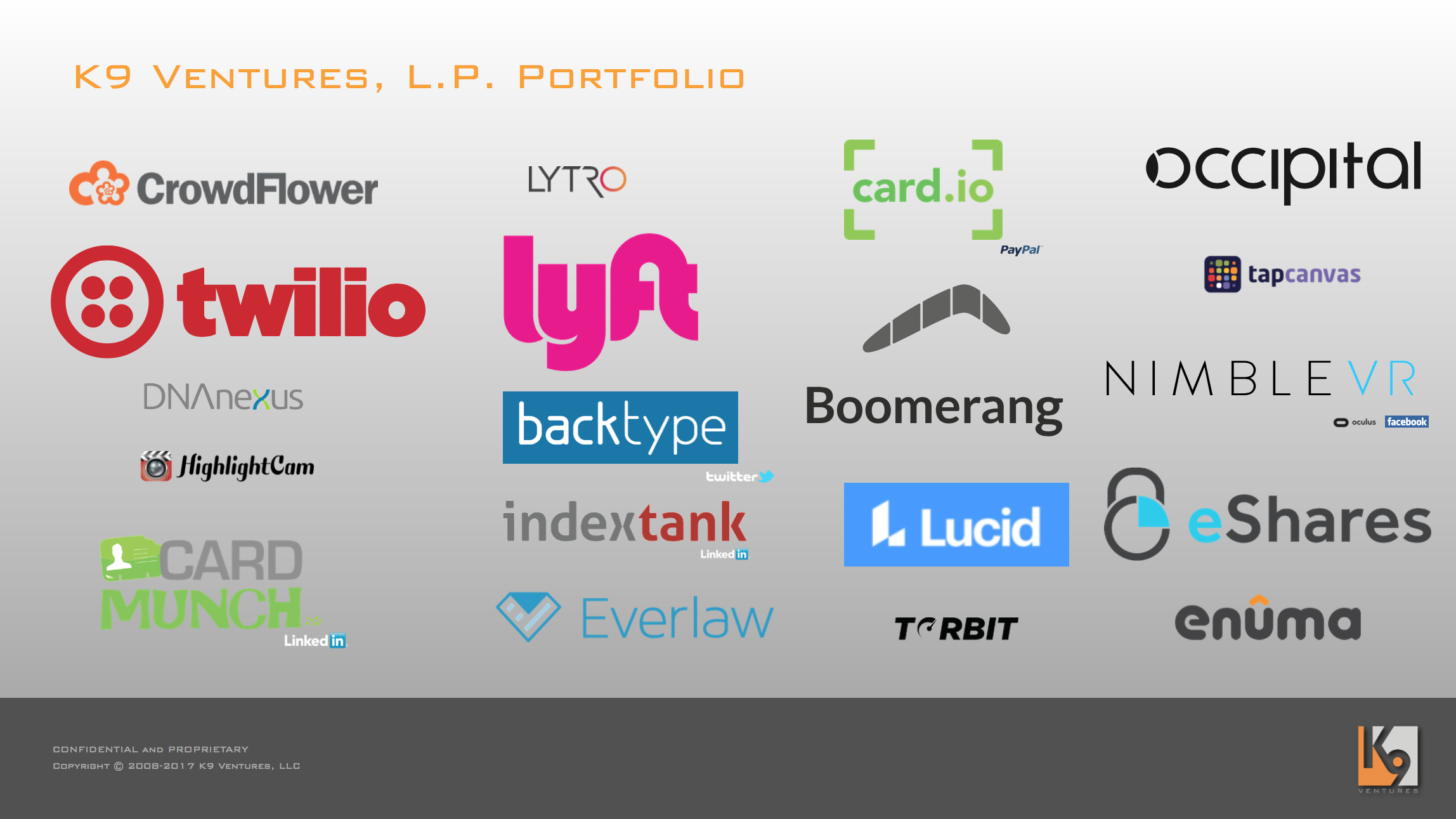

I first thought about starting K9 in 2008. Fund I, which I often refer to as a demonstration fund, started in 2009 with $6.25M under management. We invested in 19 companies through that fund. Only 2 companies out of 19 were shut down. 6 had successful M&A exits, with returns ranging from 3x – 15x. Also included in the Fund I portfolio are several companies that have already been hugely successful (Twilio, Lyft) and others that are well on their way to becoming the category leading companies in their space (LucidChart, eShares, Everlaw, Crowdflower).

K9 Ventures II began investing in 2012 and was designed to have an investment period of 5 years. We’ve invested in about 14 companies through Fund II over a period of 5 years. (Some of these companies haven’t launched yet and so we don’t list them on our site and have redacted them from the image below). Fund II is still early in its lifecycle, but it’s already been impressive to see the amazing progress of Osmo and Auth0, and I’m excited about the upcoming launches of some of the younger companies in the portfolio.

Our space, The Kennel, has been home to many of the K9 portfolio companies. A lot of people assume that The Kennel is an incubator — it is not. The Kennel is more like a shared workspace with an incredibly high bar for who gets to work out of the space. The space is free and invite-only. K9 portfolio companies are all automatically invited to work from The Kennel, if they choose to (not mandatory). The space is also often used by some of the more mature K9 portfolio companies to host offsites for their teams, and for founder events.

We’re actively and selectively investing in new companies that meet our stringent criteria. Every company we invest in has to have some unique twist that makes it interesting. If you believe you have that twist, or know a team that does, we welcome well-qualified referrals.

And remember, “It’s a tough galaxy. If you want to survive, you’ve gotta know … where your towel is.”

You can follow me on Twitter at @ManuKumar or @K9Ventures for just the K9 Ventures related tweets. K9 Ventures is also on Facebook and Google+.